A Thought On Gasoline Prices--Rats . . . Maybe They Sorta Make Sense

Instead of listening to talking heads or talk show callers to learn about gasoline prices I decided to just sit down for ten minutes and do a little math. You know...the kind of math we learned in elementary school?

In any case, I first checked out some facts on the internet (all figures are rough estimates rounded off):

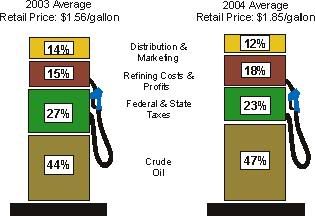

2004 average cost of a barrel of crude oil: $37

2004 average cost of a gallon of gasoline at the pump: $1.85

Cost of crude oil as a percentage of the total: 47%

This means that the crude oil cost came to .87 per gallon of gasoline

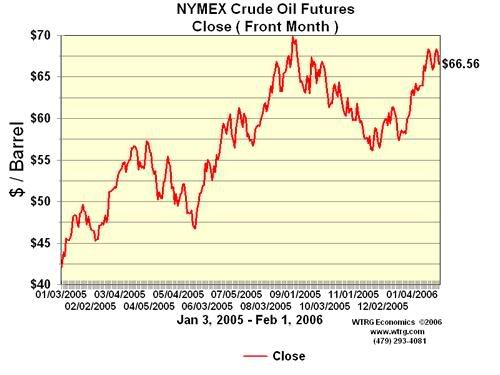

Mexican Crude (click to enlarge)

In any case, I first checked out some facts on the internet (all figures are rough estimates rounded off):

2004 average cost of a barrel of crude oil: $37

2004 average cost of a gallon of gasoline at the pump: $1.85

Cost of crude oil as a percentage of the total: 47%

This means that the crude oil cost came to .87 per gallon of gasoline

Percentage cost breakdown for gallon of gasoline

(Click picture to enlarge)

I then compared this with this past year:

2005 average cost of a barrel of crude oil (last 6 months): $65

2005 average cost of a gallon gasoline at the pump: $2.50 - $3.00

Cost of crude oil as a percentage of the total: (here is where the math comes in)

The cost of crude increased by $28

$28 is an increase of 76% over 2004

This means that the cost of crude alone added .66 to the cost of a gallon of gasoline. Therefore:

This one factor alone would have raised the cost per gallon of gasoline to $2.55 without factoring in any resulting increase in taxes (which, at an average of 23% of cost per gallon would have risen from .42 to .58, an increase in .16), refining costs (there was a hurricane, remember?) and transportation costs (those delivery trucks had to buy diesel at higher prices, too).

My guess is that with all these factors weighed in that the average price of a gallon of gasoline in 2005 ought to have been somewhere around $2.75 or so.

As it turns out that was just about what it was.

Now the cost of crude oil did fluctuate above and below that $65 per barrel figure even as the selling price of a gallon of gasoline stayed relatively stable.

Over the course of the year, the oil companies probably made an above average profit increase because of those fluctuations. But keep in mind, they had to increase prices ahead of costs because they did not know just how high the cost per barrel could go.

In short, they had to plan on the worst-case scenario or else they could have run out of cash to purchase the oil!

Fortunately for us all (you and me as well as the oil companies) the cost per barrel of oil peaked at $70 in September 2005. The national average for a gallon of gas stands today at $2.37 which sort of reflects the fact that crude dropped to around $55 at the end of last year. This past week it rose up to $66 so we can expect that gallon of gasoline to cost a little more in the weeks ahead.

Personally, I'd rather see the oil companies taking a healthy profit than "running on empty." The success of this "free market" approach to the price of gasoline does have its good side....In Europe, where much of the refinery business is still under government control, the cost of a gallon of gasoline last year went up to the equivalent of $8 US.

So, Exxon had a good year.

As a nation, we did too.

So stop complaining about the cost of gasoline and try focusing all of your energy on rising health and pharmaceutical drug costs. My simple math just doesn't add up when it comes to health care!

2005 average cost of a barrel of crude oil (last 6 months): $65

2005 average cost of a gallon gasoline at the pump: $2.50 - $3.00

Cost of crude oil as a percentage of the total: (here is where the math comes in)

The cost of crude increased by $28

$28 is an increase of 76% over 2004

This means that the cost of crude alone added .66 to the cost of a gallon of gasoline. Therefore:

This one factor alone would have raised the cost per gallon of gasoline to $2.55 without factoring in any resulting increase in taxes (which, at an average of 23% of cost per gallon would have risen from .42 to .58, an increase in .16), refining costs (there was a hurricane, remember?) and transportation costs (those delivery trucks had to buy diesel at higher prices, too).

My guess is that with all these factors weighed in that the average price of a gallon of gasoline in 2005 ought to have been somewhere around $2.75 or so.

As it turns out that was just about what it was.

Now the cost of crude oil did fluctuate above and below that $65 per barrel figure even as the selling price of a gallon of gasoline stayed relatively stable.

Over the course of the year, the oil companies probably made an above average profit increase because of those fluctuations. But keep in mind, they had to increase prices ahead of costs because they did not know just how high the cost per barrel could go.

In short, they had to plan on the worst-case scenario or else they could have run out of cash to purchase the oil!

Fortunately for us all (you and me as well as the oil companies) the cost per barrel of oil peaked at $70 in September 2005. The national average for a gallon of gas stands today at $2.37 which sort of reflects the fact that crude dropped to around $55 at the end of last year. This past week it rose up to $66 so we can expect that gallon of gasoline to cost a little more in the weeks ahead.

Personally, I'd rather see the oil companies taking a healthy profit than "running on empty." The success of this "free market" approach to the price of gasoline does have its good side....In Europe, where much of the refinery business is still under government control, the cost of a gallon of gasoline last year went up to the equivalent of $8 US.

So, Exxon had a good year.

As a nation, we did too.

So stop complaining about the cost of gasoline and try focusing all of your energy on rising health and pharmaceutical drug costs. My simple math just doesn't add up when it comes to health care!

Note: Lest you think I've gone nutters, you should know that I live in Hawaii where today's average cost for a gallon of gasoline is $2.87, the highest in the nation. (The national average is $2.37). Ouch!

<< Home